An Unbiased View of Tax Consultant Vancouver

Wiki Article

Cfo Company Vancouver Can Be Fun For Everyone

Table of ContentsEverything about Vancouver Tax Accounting CompanySome Known Questions About Cfo Company Vancouver.How Vancouver Tax Accounting Company can Save You Time, Stress, and Money.The Best Guide To Vancouver Accounting Firm

Not only will maintaining neat files and also documents help you do your task much more successfully and properly, but it will certainly likewise send out a message to your employer and clients that they can trust you to capably handle their economic details with respect and honesty. Being mindful of the many projects you have on your plate, knowing the target date for every, and prioritizing your time as necessary will make you an incredible possession to your company.

Whether you maintain a thorough schedule, set up normal tips on your phone, or have an everyday to-do listing, remain in cost of your routine. Remember to remain versatile, nevertheless, for those urgent requests that are thrown your method. Merely reconfigure your priorities so you remain on track. Even if you choose to hide with the numbers, there's no navigating the reality that you will certainly be required to communicate in a variety of methods with colleagues, managers, clients, and market specialists.

Even sending well-crafted emails is an important skill. If this is not your forte, it might be well worth your time and also effort to get some training to enhance your value to a potential employer. The audit field is one that experiences regular change, whether it be in policies, tax codes, software, or best methods.

You'll discover critical assuming skills to aid determine the long-term goals of a service (as well as create plans to attain them). As well as you'll discover exactly how to connect those plans plainly and properly. Continue reading to uncover what you'll be able perform with a bookkeeping degree. small business accounting service in Vancouver. With many job options to pick from, you could be amazed.

Get This Report about Tax Accountant In Vancouver, Bc

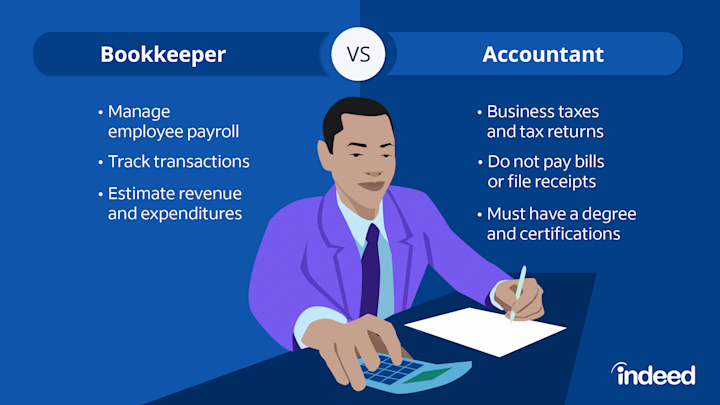

How much do accountants and also accounting professionals bill for their services? How much do bookkeepers and also accounting professionals bill for their services?To recognize pricing, it's useful to understand the difference between bookkeeping as well as audit. These two terms are frequently used mutually, but there is a substantial distinction between bookkeeping and also bookkeeping solutions. We have created in information about, however the extremely fundamental function of a bookkeeper is to videotape the deals of a company in a regular way.

Under the conventional technique, you won't know the amount of your costs until the work is full as well as the company has actually included up all of the mins invested functioning on your file. Although this is a typical rates method, we find a couple of points wrong with it: - It creates a situation where clients feel that they shouldn't ask inquiries or gain from their bookkeepers and accountants since they will get on the clock as quickly as the phone is answered.

The 45-Second Trick For Tax Consultant Vancouver

If you're not satisfied after finishing the program, just get to out as well as we'll give a complete reimbursement with no questions asked. Currently that we've clarified why we do not like the standard version, let's look at exactly how we price our services at Avalon.

we can be readily available to help with bookkeeping as well as accountancy concerns throughout the year. - we prepare your year-end financial statements as well as income tax return (virtual CFO in Vancouver). - we're here to aid with inquiries and also assistance as needed Equipment configuration and also individually bookkeeping training - Yearly year-end tax filings - Assistance with inquiries as required - We see a whole lot of local business that have yearly income in between $200k and also $350k, that have 1 or 2 staff members and also are owner took care of.

- we set up your cloud audit system and teach you how to send papers electronically and also see reports. - we cover the cost navigate to this website of the accountancy software program.

An Unbiased View of Pivot Advantage Accounting And Advisory Inc. In Vancouver

We're also offered to respond to concerns as they turn up. $1,500 for audit and also pay-roll systems setup (one-time expense)From $800 monthly (includes software application fees and also year-end costs billed month-to-month) As organizations expand, there is typically an in-between size where they are not yet huge sufficient to have their very own internal money division however are complicated sufficient that simply working with a bookkeeper on Craigslist will not suffice.Report this wiki page